Pocket Option Tax Form: Understanding Your Obligations

Ganar dinero con la opción de bolsillo

Navigating the world of online trading can be complex, especially when it comes to understanding the tax implications of your activities. As a trader on platforms like Pocket Option, it’s crucial to be aware of how your earnings are taxed and what forms you’ll need to complete. This article aims to provide a detailed overview of the Pocket Option Tax Form and related obligations so you can ensure compliance and avoid any unforeseen liabilities.

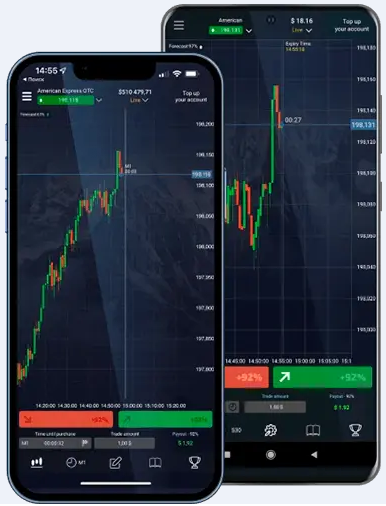

What is Pocket Option?

Pocket Option is a trading platform that allows users to engage in binary options trading. Founded in 2017, it has quickly gained popularity due to its user-friendly interface and wide range of trading assets, including currencies, commodities, and cryptocurrencies.

Why Taxes Matter in Trading

Taxes are a significant aspect of any financial activity, and trading is no exception. The profits you make from trading are considered taxable income in most countries, and failing to report them accurately can result in significant penalties. Understanding the tax requirements related to trading can help you make informed decisions and manage your finances better.

The Pocket Option Tax Form

While Pocket Option itself does not provide specific tax forms to its users, it is still your responsibility to accurately report your earnings. The key is to keep thorough records of all your trades, gains, and losses, as this information will form the basis of your tax reporting.

Typically, the data you need to report will include:

- The total amount invested.

- The total earnings from successful trades.

- The losses incurred from unsuccessful trades.

- Any fees or commissions paid to the platform.

How to Report Pocket Option Earnings

Reporting your earnings depends largely on your country of residence. For example, in the United States, you’ll generally need to declare trading income on form 8949 and summarize it on Schedule D with your tax return. Other countries will have different forms and procedures, so it’s important to consult with a tax professional who understands trading and your local regulations.

Tips for Managing Taxes on Pocket Option

Here are a few tips to help you manage your trading taxes more effectively:

- Keep Detailed Records: Maintain a ledger of all your trading activities. Include details such as the date, time, investment amount, earnings, and losses.

- Use Trading Software: Consider using financial software or apps to track your trading activity automatically.

- Consult a Tax Professional: Hire a CPA or tax advisor knowledgeable in trading to help you prepare your tax returns.

- Stay Informed: Tax laws change frequently, and staying updated can help you remain compliant.

- Plan for Tax Payments: Set aside a portion of your trading profits to cover your tax liabilities.

Common Challenges and Solutions

Many traders face challenges such as complex transactions, unsure tax obligations, or even different tax treatments of various trading activities. Here are some solutions:

- Complex Transactions: Focus on organizing your data clearly and consult experts if needed.

- Uncertainty in Reporting: Professional guidance can help decipher which trades are taxable in your jurisdiction.

- Understanding Tax Treatments: Differentiate between ordinary income tax rates and capital gains tax rates applicable in your area.

Conclusion

Trading on platforms like Pocket Option can be lucrative, but it’s important to understand the tax implications. While Pocket Option may not issue specific tax forms, keeping meticulous records and seeking professional help can simplify the process significantly. By understanding and complying with your tax obligations, you can focus more on your trading strategies and less on potential legal issues.

In summary, managing taxes as a trader involves organization, knowledge, and often, professional assistance. Whether you are a seasoned trader or just starting, ensuring your tax affairs are in order is crucial for a smooth trading experience.